Apparel Retail Margin Expectations

Extrapolating Unsustainable Tailwinds Suggests Negative Risk-Reward

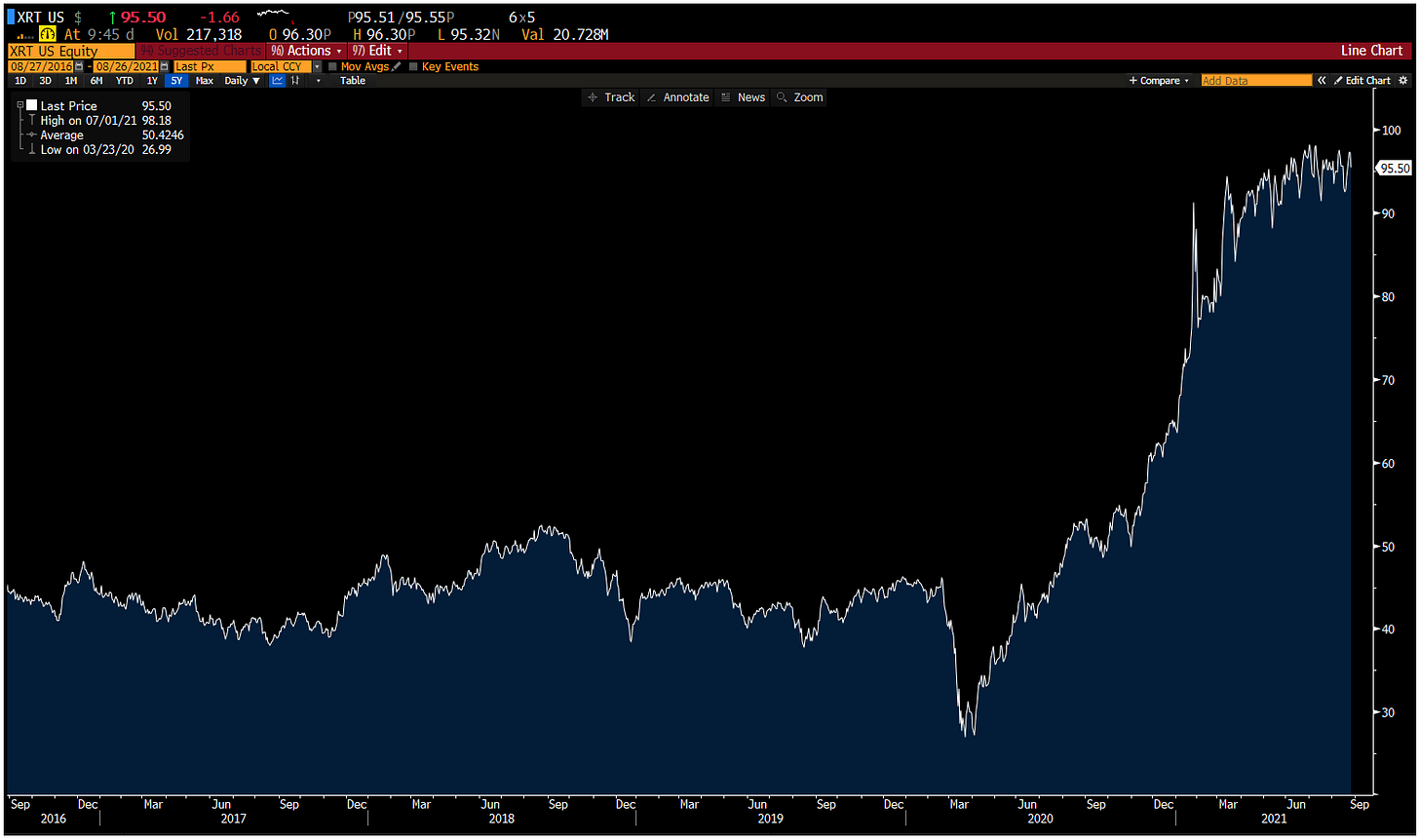

The XRT-rampoline

Below is the price chart for the S&P Retail ETF (XRT). The index had gone nowhere from 2013 to early 2020 where it took a nosedive, found a trampoline, and never looked back. Part of this can be explained by the underlying performance of some of its more questionable constituents, like GameStop (retail apes can send the hate mail directly to my analyst, Mark). Part of it can also be explained by turbo-charged consumer spending behaviour courtesy of stimmy checks and cancelled travel plans. Lastly, the shift-to-online narrative has also led investors to believe these margin improvements are permanent. We believe this narrative is mostly just that – a narrative.

Pre-vs-Post Covid Margin Estimates

The following group of mid-cap apparel retailers are getting walloped this morning, prompted me to write a short post. These stocks are well off their respective peaks but are still trading much higher than pre-Covid ranges. Begs the question – why?

Turns out, analysts expect post-Covid EBITDA and net income margins to be ~45% and ~100% higher, respectively. We feel these margin expectations are far too optimistic.

Unsustainability Explored

Recent margins have been unsustainably high for various reasons such as: a channel shift to online, heightened demand from stimmy checks, pricing power from supply challenges, G&A overhead expense reductions, lower rent payments, etc. We agree with analysts that some of the cost savings for specific companies will be permanent.

The immediate, and obvious, conclusion is to model higher margins. But sustainable margin profiles across an entire industry are not driven by company-specific factors. There may be winners and losers within that space. There may be short-term gyrations around that long-term average. But collectively, margins are driven by the strength of the economic moat for that industry. As such, apparel retail margins will likely revert to the mean.

Simply put, the pandemic did not erect new barriers to entry. It didn’t magically make cotton t-shirts a differentiated product. Can these brands collectively drive more pricing power? Probably not.

We understand channel mix shift to online and G&A optimization can drive margin improvement when you evaluate each company in isolation. But what happens when all competitors in a competitive industry benefit the same way to a similar degree? That advantage will get competed away. That’s how competition and competitive dynamics work.

We don’t believe the pandemic has caused any radical structural changes that will drive forward ROIs in apparel retail higher. Our base case is that stimmy check tailwinds will dissipate and cost saving advantages will get competed away as things normalize. Our expectation is long-term margin profiles for the industry as a whole will look more like 2016-19 than 2020-21.

Negative Risk-Reward

Unprecedented revenue and margin tailwinds have caused analysts to extrapolate positive fundamental momentum indefinitely. We think this degree of optimism is premature. Apparel retailers will once again have to compete for market share in a low-growth competitive landscape with very little product differentiation. This will ultimately drive margins and ROIs back down to long-term historical averages.

Will there be individual winners and losers in the space? Of course. Will more companies fall short of expectations than those that exceed them? Highly likely, meaning the margin for error for stock-pickers is slim.

These businesses appear cheap on an absolute basis but are close to peak valuation multiples relative to where they have traded in the past. Peak multiples based on peak revenues and peak operating margins suggests a negatively skewed risk-reward.

LEGAL INFORMATION AND DISCLOSURES

This commentary is intended for informational purposes only and should not be construed as a solicitation for investment in the Kinsman Oak Equity Fund. The Fund may only be purchased by accredited investors with a high risk tolerance seeking long-term capital gains. Read the Offering Memorandum in full before making any investment decisions. Prospective investors should inform themselves as to the legal requirements for the purchase of shares.

The views expressed are those of the author as of the date indicated. Such views are subject to change without notice. The information in this document may become outdated. The author has no duty or obligation to update the information contained herein. Forward-looking statements, including but not limited to, forecasts, expectations, or projections cannot be guaranteed and should not be relied upon in any way. Actual results or events may differ materially from any forward-looking statements contained herein. The author has no obligation to update or revise any forward-looking statements at any time for any reason. Do not place undue reliance on forward-looking statements.

This document is being made available for educational and informational purposes only. The information or opinions contained herein do not constitute and should not be construed as investment advice under any circumstance. Investing involves risk including the complete and total loss of principal.

In preparing this document, the author has relied upon information obtained from independent third-party sources. The author believes that these sources are reliable and the information obtained is both accurate and complete. However, the author cannot guarantee the accuracy or completeness of such information and has not independently verified the accuracy or completeness of such information.

The author may from time to time have positions in the securities, commodities, currencies or assets mentioned herein. References to specific securities, commodities, currencies or assets should not be construed as recommendations to buy or sell a security, commodity, currency or asset. Furthermore, references to specific securities, commodities, currencies or assets should not be construed as an indication of any past, current, or prospective long or short positions held by the author.